The Effect of Net Exports

The Effect of Net Exports can be positive or negative, depending on the country’s overall importer and exporter status. High net exports indicate that a country is generating money from foreign countries. This money can be used to buy more goods from other countries, which is positive for the country’s financial status. Positive net exports can also result in positive net imports. Nevertheless, the impact of net exports is often debated.

Positive net exports

Gross domestic product (GDP) is the market value of all goods and services produced within a nation’s borders. In addition to total imports and exports, net exports are also a component of GDP. When a country has a positive net exports figure, it is a sign of trade surplus. Negative net exports, on the other hand, mean a country has a trade deficit. The U.S. has historically been a net importer.

A positive net exports value indicates a strong economy. The value indicates that a country or company is exporting more than it imports. It also indicates a trade surplus. Positive net exports indicate that a country’s economy is robust and it is able to be more self-sufficient. Whether a country’s exports are negative or positive, the net exports value is a key indicator of its economic health.

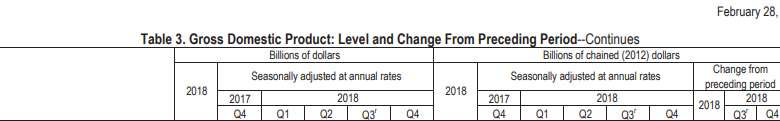

Changes in GDP

Changing net exports and GDP affect aggregate demand in different ways. The rise and fall of net exports affect the aggregate demand curve and, thus, the real GDP of a country. In the United States, the decrease in net exports caused a slowdown in real GDP in 1998. This was because the Asian slide reduced incomes in the region and consequently, decreased demand for U.S. goods. However, other countries also have an impact on net exports and real GDP.

The change in net exports and GDP in the United States are reflected in two ways: a change in quantity and change in price. Sometimes, changes in net exports and GDP are measured in the same way, but some analyses require the separate effect of these two factors. Despite these differences, the net exports and GDP measures of a country’s economy have a lot to do with each other. In the United States, net exports represent the value of domestic production sold abroad.

International trade effect

The change in the price level of a good or service affects the amount of net exports an economy has. As a result, the aggregate demand curve shifts to the right by the amount the multiplier times the change in net exports. The opposite is also true: if the price level of a good or service decreases, the amount of net exports increases. This shift in net exports is reflected in the change in the price level of a good or service.

The extent of the trade effect varies among households with different skill levels, industry affiliations, and weights of importance placed on different products. The result is a net welfare impact for each household. The effect on the welfare of the entire population can be estimated by comparing households of different income levels. In addition, a recent study extends this framework to include the impact of trade on consumption baskets and labor incomes.

Examples of net exporters

Two of the world’s largest economies are examples of net exporters. Germany and China have huge current account surpluses and, as a result, are considered to be examples of net exporters. These countries have a history of trade surpluses – they account for over 42% of the global surplus in 2015 alone. However, their surpluses are not always indicative of a country’s overall prosperity or economic health.

A nation that has ample amounts of natural resources may experience a higher net export. Other nations may want to buy the raw materials or products produced by the country’s industry. Countries with limited land and water may have to rely on imported products, while countries with a lot of land might be able to grow some raw materials to increase exports. Here are some examples of nations that are net exporters.

We have come to the end of our content about the The Effect of Net Exports. In order to access more relevant content, please provide a search based on Google Dec