How to Make Online Customs Duty Payments

How to Make Online Customs Duty Payments, There are several methods to make payments to the customs department. One such method is the customs deferred payment system, also known as bank direct debit. This system allows you to delay payment of taxes and duties for up to 15 days, as long as you provide a bank guarantee or cash deposit and meet all other conditions set forth in the authorisation. However, it is important to note that you cannot use this method to make payments if you are not going to be around to make the payment when the due date is approaching.

ICEGATE portal

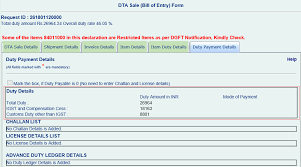

You can use ICEGATE to file your customs bills online. This portal is useful for traders, cargo carriers, and other individuals. It provides you with information about taxes and customs bills. It also has various steps for registration. For registration, you need to have a valid GSTIN or IEC number. To register, you must follow the instructions given by the portal. Then, you should set up a password and follow the on-screen instructions.

To use ICEGATE, you need to be registered as an importer or exporter. You must verify your GSTIN and IEC to complete the registration process. You can also verify your password by using OTPs that are sent to your registered email and mobile number. Once you have verified your account, you can begin filing documents online. The payment process will take about two weeks. Once you have submitted the documents, the customs office will release the shipping bill.

ICICI Bank’s Corporate Internet Banking (CIB)

ICICI Bank’s eazypay offers a wide range of online payment methods, including RTGS, NEFT, and UPI. You can also integrate eazypay with your Zoho Books account. To use CIB for custom duty payment, you must first associate your bank account with eazypay. Once you’ve done this, you can then pay custom duty electronically via ICICI Bank.

The new ICEGATE e-payment service makes custom duty payments easy for ICICI Bank customers. They can pay the customs duty via their corporate internet banking or retail internet banking platform. In addition to this, they can also pay custom duty through the Indian Customs Electronic Gateway. The ICICI Bank’s new service means that customs duty payments can be made faster than ever before.

ICICI Bank’s Retail Internet Banking Platform

Customers of ICICI Bank can pay custom duty online through ICEGATE, the Indian Customs Electronic Gateway. To pay custom duty online, customers must log in to their Internet banking account and select the appropriate document type, location code, Import Export Code, and bank. After selecting the bank, they must select the country and enter their customer number and password. Then, they can continue their payment process.

With this facility, ICICI Bank’s retail and corporate customers will be able to make payments for custom duty online. For customers who are new to the process, the bank offers two ways to pay custom duty. The first option allows corporate customers to use their corporate Internet Banking platform, while the latter is made through its mobile app InstaBIZ. However, for retail customers, this means using the bank’s Retail Internet Banking Platform.

FedEx courier handling fee to process payments for DDP

When shipping goods to other countries, there’s a fee that needs to be paid when customs clear your package. FedEx charges a courier handling fee to process custom duty payments, which can be as high as $30. For the most part, this fee is waived for CSA-certified companies and low-risk importers. Depending on your shipping requirements, you can choose between a DDU or DDP service to expedite the clearance process, and pay customs duty directly to the courier.

FedEx can help you set up a direct debit to make payments online or over the phone. When processing payments online, make sure you have your invoice number handy. You can find the invoice number on the top right-hand corner of your duty and tax invoice. It’s located below your bank account number. It’s important to note that you should never send your card details over email or in written form to a FedEx courier.

UPS courier handling fee to process payments for DDP

Upon delivery, UPS will assess an ICOD, or import charge, for processing custom duty payments. When processing shipments, this fee covers the first five classification lines. Line charges only apply to shipments requiring government clearance. UPS My Choice offers advance notification of ICOD charges. In some cases, additional charges are associated with custom duty payments. Generally, shipments will incur a processing fee if they require government clearance.

If your package is held for customs purposes, UPS will contact the recipient to arrange for the payment. Depending on the amount of fees, this fee may be as high as $16 per shipment. For most shipments, this fee will be less than $10, although it may be higher for shipments requiring complex customs clearance. The fee is typically billed separately. It is noted in the Additional Charges Table.

FedEx standard courier handling fee to process payments for DDP

For international shipping, you should consider the courier’s standard handling fee for processing custom duty payments. UPS and FedEx charge about $15 USD for this service, but you may have to pay more or less depending on the country from which your parcel originated. To avoid any confusion, be sure to check the details of your shipping charge before you place your order. Below are the steps to follow to avoid having to pay additional fees for customs clearance.

For shipments to a foreign country, FedEx charges a declared value fee. This fee is a minimum of $2.40. Depending on the type of shipment, you may also be charged an additional delivery area fee. This charge is typically $2.75 per package or $3.25 for FedEx Home Delivery shipments. If you aren’t sure which service to use, FedEx offers a list of the 2012 fees for this service.

We have come to the end of our content about the How to Make Online Customs Duty Payments. In order to access more relevant content, please provide a search based on Google Dec