African Imports

African Imports is an initiative founded by Wayne Kiltz, an admissions hospital worker in Mali, West Africa. While working with these people, he discovered their traditional creativity and need for goods. The idea of creating a distribution network for these goods in the U.S. and creating a sustainable source of income for them came to him. As a result, African Imports was born. Its success is due in part to Kiltz’s vision and determination.

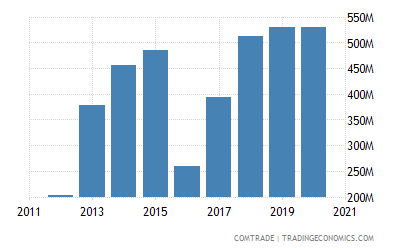

Trade

The African exports trade data is a vital tool for determining potential business opportunities. The data covers any industry and HS-classified product. Moreover, the data covers every company, commodity, market, and aspect of trade in a particular African country. For example, the exports trade data of Seychelles is very useful for determining the export potential of a country. Moreover, the data on imports of Mauritania shows that the country trades heavily with the Japanese market, accounting for around 30% of its exports.

The African Continental Free Trade Agreement, or AGOA, has paved the way for further trade liberalization, enabling African countries to break into new markets and diversify their export destinations. This trade deal also calls for U.S. trade representatives to assess the prospects for a free trade agreement with Africa. The African Continental Free Trade Agreement entered into force on May 2017.

Trends

The volume of African exports has risen significantly since the end of World War II, and the growth has compared favourably to other developing regions. Africa’s exports, however, have remained lower than its imports for a considerable period. The expansion is largely attributed to the surge in demand for primary commodities during World War II and the immediate postwar reconstruction period. The drive for export expansion was further reinforced with the attainment of independence by many African countries.

The continent’s growing population and changing lifestyles are driving demand for processed food. As a result, there is considerable untapped potential in intra-African trade. South Africa alone accounts for over one third of the continent’s food trade. With the AfCFTA in place, farmers in Africa will be able to meet the growing demand for food. It is also an important factor in Africa’s economic growth. The continent’s rapidly expanding population has contributed to a substantial increase in the region’s agricultural output.

Commodities

The Bank of America Merrill Lynch’s map shows that many African economies rely on the export of commodities. From Algeria to Zimbabwe, the continent exports a wide range of items, including oil, metals, and grains. The report describes the risk associated with a volatile commodities market and details the importance of African countries in these markets. Several African countries, including Algeria and Nigeria, depend on commodity exports. In fact, oil and gas account for more than one-third of their GDP.

Agricultural products account for a large share of South Africa’s imports. According to the United Nations’ COMTRADE database, South Africa imported more than $5 billion of agricultural products in 2014. In 2014, the U.S. accounted for nearly a quarter of the agricultural imports of the country. Agricultural products included processed foods, poultry, and wine and beer. Despite the country’s growing self-sufficiency policies, the U.S. still remains the top supplier of wheat to South Africa. In fact, the exports of United States agriculture in the country fluctuate between $10 million and $100 million. EU agriculture holds about thirty-five percent of the South African market, while the U.S. only possesses four percent.

India

A key part of India’s trade policy with Africa is the “Focus on African” programme. The programme, launched under the EXIM policy of India, identifies African countries as target markets. The Government of India supports the creation of markets in Africa by providing financial support to export promotion councils, trade promotion organizations, and the government’s Focus on Africa programme. The focus on African markets reflects India’s interest in improving its trade relations with Africa.

The Automotive Export Manual shows that India is the leading country of origin for vehicle imports to South Africa. Despite the decline in vehicle sales due to the Covid-19 pandemic, South Africa’s imports of India vehicles were still higher than those from any other country. Vehicle imports in South Africa from India rose by R26.8 billion in 2020, but the value of vehicles exports is expected to decrease over the same period.

China

The Chinese are increasing their imports of African goods. The trade between Africa and China has increased exponentially in recent years, with exports to China doubling or even tripling in some countries. The DRC, for example, has increased its exports to China 400 percent, while Togo and Sierra Leone have almost doubled theirs. Madagascar, Burkina Faso, and Eswatini are also seeing significant increases in their exports to China. Some African countries are doing their part to lower their trade deficits with China, including Kenya, which has developed an online platform for selling agricultural products.

There are also several maps available that show total African exports to China each year. These show how important specific African countries are to China as a source country, but they do not depict the relative importance of China as a destination country for African exports. However, a more recent map shows that China remains the largest trading partner of African nations. This is not to suggest that Africa will suddenly stop exporting its goods to China.

South Africa

In 2021, the country will import $93.5 billion worth of goods from other countries. These imports are expected to reach $1,550 per person, a figure that will surpass the $1,200 average for the year 2020. In addition to its diverse economic base, South Africa is a major source of exports, including gold, diamonds, grains, fruits, and meat. In addition, South Africa imports a wide variety of manufactured goods from other countries, including Japan, India, and the United States.

In order to import goods to South Africa, suppliers must complete a commercial invoice, including the value of the goods. In addition, suppliers must provide a full description of the goods to be imported. This description is used by Customs SA to assess import duty and compile statistics. An original copy of the Commercial Invoice and a copy of the insurance certificate are also required. During shipment, South African Customs officials may demand three copies of the Packing List.

We have come to the end of our content about the African Imports. In order to access more relevant content, please provide a search based on Google Dec